|

Authors

|

Ten years ago, the world committed itself to keeping global warming well below 2°C (and preferably below 1.5°C) above the pre-industrial era.

This would be done by reducing greenhouse gas emissions significantly by 2030 and ending all human-caused greenhouse gas emissions by 2050.

This was the time of promises, with 195 countries signing up to the legally binding, global treaty on climate change, the Paris Agreement.

Ten years on, however, the climate crisis is more urgent than ever.

The first 12-month period to exceed 1.5°C as an average was February 2023–January 2024, boosted by El Niño, when the average temperature worldwide was estimated to be 1.52°C higher than 1850–1900.

There’s a disconnect between stated policies and actual practices, and we wanted to find out why.

We are media and communication researchers focusing on environmental communication.

Recently, we joined a team of 14 researchers who investigated misinformation about climate change for the International Panel on the Information Environment.

Our team carried out the most comprehensive review to date of scientific research on climate misinformation and disinformation.

Climate misinformation is when people make mistaken claims about climate change and spread incorrect information.

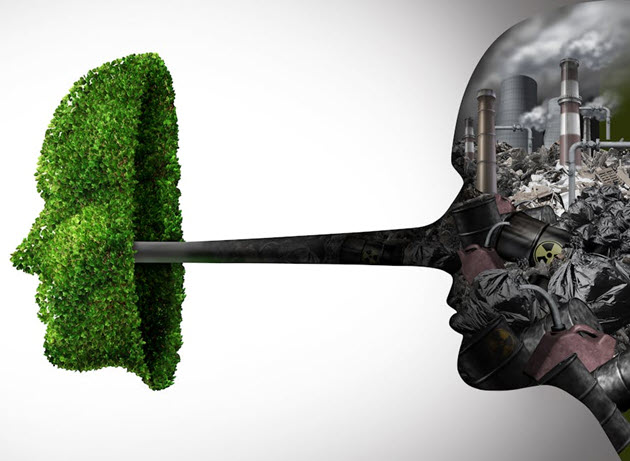

Climate disinformation is where false information is spread deliberately – for example, corporations that greenwash their products so that they can sell more.

(Greenwashing is where false claims are made that products or services are environmentally friendly when they aren’t).

We reviewed 300 studies published between 2015 and 2025, all of which centred on climate misinformation.

Our study found that the human response to the climate crisis is being obstructed and delayed by the production and circulation of misleading information.

We found that this is being done by powerful economic and political interests, such as fossil fuel companies, populist political parties, and some nation states.

The public needs access to accurate information about climate change, because this enables them to take action to stop global warming.

Without accurate information, none of us will be able to do the right thing for coming generations and the wider natural world.

How we tracked down who is fooling the public

Climate science has been documenting the growing climate crisis and solutions for decades.

The United Nations says access to information about climate change is a human right.

They’ve even outlined a set of global principles for maintaining the integrity of publicly available information about climate change.

However, our study shows that misleading information is adding to the climate crisis.

Our research looked into five basic questions: who, says what, in which channel, to whom, and with what effects?

What we found was:

- Who: Powerful economic and political interests such as fossil fuel companies, political parties, governments, and nation states, operating via opaque alliances and think tanks like The Heartland Institute.

- Says what: Strategic scepticism downplays climate change impacts, delays emissions reductions, and casts doubt on science-based solutions.

- In which channel: Misinformation circulates through traditional mass media, social media, and greenwashed corporate reports.

- To whom: Everyone, especially decision-makers such as policymakers and public servants, often influenced via think tank briefings.

- With what effects: Misinformation erodes public trust and delays climate action, worsening the crisis.

What needs to happen next

- Legislation: Ensure transparent and standardised climate reporting and require platforms to flag misinformation.

- Lawsuits: Prosecute companies for greenwashing and deception, framing misinformation as consumer fraud.

- Coalitions of the willing: Form grassroots, cross-sector movements like Climate Action Against Disinformation to counterbalance corporate influence.

- Education: Boost climate and media literacy for the public and policymakers to support informed decision-making.

- Research in Africa: Address the major gap by funding local research led by African scholars. Only one study was found across the whole continent.

COP30

Brazil will host COP30 in November 2025. The country has launched a Global Initiative for Information Integrity on Climate Change to address disinformation.

This marks the first serious effort to fill knowledge gaps around information integrity in the climate space.

The urgency of both the climate and disinformation crises demands immediate action by leaders, researchers, and citizens.

The narrow window between 2025 and 2050 is critical to averting catastrophic climate impacts.

Access to accurate, actionable information is essential for navigating and overcoming this challenge.

Links

- Climate misinformation is rife on social media – and poised to get worse

- Selling climate uncertainty: misinformation and the media

- Climate change misinformation fools too many people – but there are ways to combat it

- On Twitter, fossil fuel companies' climate misinformation is subtle – here's what I'm seeing during COP26

- Climate change journalism in South Africa misses the mark by ignoring people’s daily experiences