QuickTake: Trump Pushes Coal Revival

Wind and solar are about to become unstoppable, natural gas and oil production are approaching their peak, and electric cars and batteries for the grid are waiting to take over. This is the world Donald Trump inherited as U.S. president. And yet his energy plan is to cut regulations to resuscitate the one sector that's never coming back: coal.

Clean energy installations broke new records worldwide in 2016, and wind and solar are seeing twice as much funding as fossil fuels, according to new data released Tuesday by Bloomberg New Energy Finance (BNEF). That's largely because prices continue to fall. Solar power, for the first time, is becoming the cheapest form of new electricity in the world.

But with Trump's deregulations plans, what "we're going to see is the age of plenty—on steroids," BNEF founder Michael Liebreich said during a presentation in New York. "That's good news economically, except there's one fly in the ointment, and that's climate."

Here's what's shaping the future of power markets, in 15 charts from BNEF:

Government subsidies have helped wind and solar get a foothold in global

power markets, but economies of scale are the true driver of falling

prices. Unsubsidized wind and solar are beginning to outcompete coal and

natural gas in an ever-widening circle of countries.

The U.S. may not be leading the world in renewables as a percentage of grid output, but a number of states are exceeding expectations.

Wind and solar have taken off—so much so that grid operators in

California are facing some of the same challenges of regulating the

peaks and valleys of high-density renewables that have plagued Germany's

energy revolution. The U.S. boom, while not the first, has been

remarkable.

Electricity demand in the U.S. has been declining, largely due to

increased energy efficiency in everything from light bulbs and TVs to

heavy manufacturing. In such an environment, the most expensive fuel

loses, and increasingly that's coal.

With renewables entering the mix, even the fossil-fuel plants still in

operation are being used less often. When the wind is blowing and the

sun is shining, the marginal cost of that electricity is essentially

free, and free energy wins every time. That also means declining profits

for fuel-burning power plants.

The bad news for coal miners gets even worse. U.S. mining equipment has

gotten bigger, badder, and way more efficient. Perhaps the biggest

killer of coal jobs is improved mining equipment. The state of

California now employs more people in the solar industry than the entire

country employs for coal.

Historically, economic growth has gone hand-in-hand with increased

energy consumption. Advances in efficiency are changing that, too. Call

it the Great Decoupling.

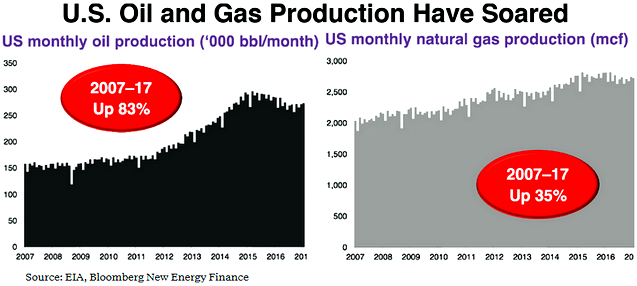

The sharpest change in U.S. energy has been driven by advances in oil

and gas drilling through shale rock. This type of horizontal drilling

has also seen enormous improvements in efficiency, deploying fewer

workers, fewer rigs, and drilling fewer wells to produce ever-more

fossil fuels. The natural gas that comes out of these wells is

practically free.

But demand for that oil and gas may not be long for this world. The world's cars are getting wildly more efficient.

And the biggest threat to oil markets—electric cars—is just getting

started. Joel Couse, the chief economist for Total SA, told the BNEF

conference that EVs will make up 15 percent to 30 percent of new vehicles by 2030, after which fuel "demand will flatten out," Couse said. "Maybe even decline."

Couse's projection for electric cars is the highest yet by a major oil company and exceeds BNEF's own forecast.

The outlook for electric cars—and for battery-backed wind and solar—is

improving because the price of lithium-ion packs continues to tumble.

The shift to cleaner energy is ridding the air of local pollutants

that cause heart disease, asthma, and cancer, as well as the greenhouse

gas emissions responsible for climate change. Trump's Energy Secretary,

Rick Perry, told the BNEF Summit that the U.S. should remain in the Paris climate accord, but should renegotiate it to draw out stronger pledges from European countries.

Meeting

U.S. commitments made under President Barack Obama shouldn't be too

difficult. America is already half way to meeting its 2025 goal.

And cleaning up emissions hasn't exactly burdened consumers. Personal

expenditures on electricity and fuels is down significantly.

Just meeting the Paris goals for emissions reductions doesn't go

far enough to fend off the catastrophe scientists anticipate from

climate change. Eventually the economy will need to decarbonize

completely—in energy, agriculture, construction, manufacturing, and land

use. And solutions for some of the trickiest and most expensive parts

of that equation are still decades away.

Fortunately, global energy markets at least seem headed in a cleaner direction.

Links

- Biggest U.S. Companies Setting More Renewable-Energy Targets

- China’s $290 Billion New Area Lifts Hope for Better Cities

- Let's Get to Work on a Global Energy Grid

- China Doubts U.S. Climate Pledge as Trump Mulls Paris Exit

- Republican Cracks Emerging in Trump's Coal-Heavy Energy Plan

- Clean Energy Isn’t Just the Future—It’s the Present

No comments:

Post a Comment