|

| Abbott and his followers seem determined to perpetuate the current energy policy uncertainty. |

In fact, he should embrace the Emissions Intensity Scheme option - detested by hardline conservatives like Abbott so intensely that the Turnbull government abandoned it in December - because that is the policy option that preserves the largest role for existing coal plants out to 2050.

That's according to the modelling by energy consultants Jacobs Group (Australia) for the Finkel review of energy security.

Abbott and his followers seem determined to perpetuate the current energy policy uncertainty, under which the Renewable Energy Target tops out in 2020 (subsidies are available until 2030) and there is no other policy signal to help guide investment and meet our Paris emissions reduction goals.

|

| Under business as usual, coal power falls to a fifth of total demand. Jacobs Group (Australia) |

But Jacobs modelling clearly shows that coal would still be supplying a larger amount of power in 2050 under an Emissions Intensity Scheme (EIS) or a Clean Energy Target (CET) than it would be under the "business as usual" scenario.

Under business as usual, coal's share of grid electricity supply would fall from 137,000 gigawatt hours in 2020 to less than 50,000 GWh in 2050. By contrast, under the CET coal plants would still be pumping out 57,000 GWh by 2050, and under an EIS coal would still be supplying 61,000 GWh.

No-one wins from chaos

The result seems perverse. It comes about, according to Jacobs, because business as usual - essentially the suite of policies bequeathed to the nation by the shortlived Abbott Prime Ministership - is not good for plant owners or investors.

Uncertainty is highest, investment signals are muddy and coal plant owners have the least incentive to invest in the minimal upgrades and maintenance needed to prolong the lives and efficiency of their plant.

|

| Under a Clean Energy Target, coal use would be higher than under business as usual. Jacobs Group (Australia) |

In short, no-one wins from chaos. Without continuing policy signals to encourage investment in wind and solar power, which increases supply and reduces wholesale prices because they have near zero marginal operating costs, retail prices are 7-10 per cent higher than they would be under a CET or an EIS. Industrial prices are more than 10 per cent higher under business as usual than under a CET or an EIS.

Coal is in decline

Old King Coal can bow out of the energy mix gracefully or disgracefully.

|

| Coal would retain a larger role under an Emissions Intensity scheme than under business as usual or a Clean Energy Target. Jacobs Group (Australia) |

Total demand increases from about 200,000 GWh today to about 230,000 GWh in 2050. Coal's share of total demand falls from just more than two-thirds today to somewhere between a fifth and a quarter in 2050.

As Jacobs modelling shows, the withdrawal can be managed with optimal minimal plant upgrades and maintenance under CET/EIS policies, or the plant owners can do the bare minimum under business as usual, resulting in less efficiency, greater emissions, more unexpected failures and closures.

Hazelwood's closure in March - after just five months notice - is a good example. Owners Engie of France and Mitsui of Japan faced a $400 million bill - partly under pressure from Worksafe Victoria - to make the plant fit for use. They saw the writing on the wall and chose to close it.

|

| Electricity prices are lowest under a Clean Energy Target, the Jacobs than under an Emissions Intensity Scheme or business as usual. Jacobs Group (Australia) |

Abbott and some of his followers dismiss Finkel - and by implication Jacobs' modelling - as "magic pudding" economics, or something akin to snakeoil.

All modelling depends on assumptions, and all assumptions are open to challenge.

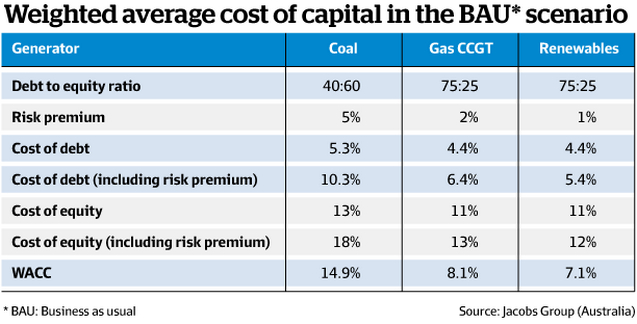

One of Jacobs' assumptions adds a 5 per cent risk premium to the cost of building new coal plants, on the grounds that it faces risks - stronger climate policies, carbon prices etc - that could curtail their lives early, before the investors or lenders have got their money back.

|

| Coal plant has a much higher cost of capital than renewable or gas plant because of the risks. Jacobs Group (Australia) |

On this basis, Jacobs attributes a 14.9 per cent average cost of capital to coal pant, compared to just 8.1 per cent to gas plant and 7.1 per cent for renewable plant.

That helps to make coal plant uneconomic. Coal advocates are likely to seize on it as another reason to dismiss the modelling.

But it doesn't look all that unreasonable. No coal plants have been built in Australia for 10 years, partly because business now ascribes a carbon cost to new investments.

Clean coal is barely competitive

Jacobs' modelling doesn't include a carbon price. BHP Billiton assumes a carbon price of $US24 ($32) a tonne of carbon dioxide under current policies, and $US50 ($62) a tonne of CO2 under stronger policies aimed at limiting temperature increases to 2 degrees Celsius - the baseline Paris commitment.

That would add $22 to $43 a MWh to the $81/MWh price of power from an ultra-supercritical coal plant - the most efficient commercial plant - modelled by the Finkel Review.

The Finkel review finds new ultra-supercritical coal plant costs uncompetitive with wind even without a carbon price and even when some storage is added to a wind plant. They're barely competitive with large scale solar.

Finkel's findings on all-in costs look conservative. Other forecasters, such as Bloomberg New Energy Finance, find the cost of wind and solar even more competitive with coal than Finkel.

The latest wind farm deals confirm this. Origin Energy's sale of Stockyard Hill and AGL Energy's sale of Silverton wind farm included power purchase agreements at $52/MWh and $65/MWh respectively - less than new coal plant without a carbon price.

Links

- Alan Finkel Auditions For The Role Of Australia's Chief Political Scientist

- Defence of Adani coal useless: world’s energy agency

- The man who could bring peace to Australia's climate wars

- The Finkel review explained: what's in it, and why you should care

- Finkel climate review outlines Clean Energy Target

- 'Pinch year': Power price surge set to knock out smaller energy retailers

- Bill Shorten offers 'olive branch' to Malcolm Turnbull on climate

Interesting Article. Hoping that you will continue posting an article having a useful information. Compare Gas Rates

ReplyDelete